Nvidia is most likely to be primed to be the next AWS | TechCrunch – Techcrunch

Nvidia and Amazon Internet Providers and products, the lucrative cloud arm of Amazon, enjoy an dazzling amount most regularly. For starters, their core corporations emerged from a blissful accident. For AWS, it was as soon as realizing that it could possibly sell the inner products and services — storage, compute and memory — that it had created for itself in-dwelling. For Nvidia, it was as soon as the undeniable truth that the GPU, created for gaming functions, was as soon as also successfully matched to processing AI workloads.

That indirectly ended in a couple explosively rising earnings in fresh quarters. Nvidia’s earnings has been rising at triple digits, inspiring from $7.1 billion in Q1 2024 to $22.1 billion Q4 2024. That’s a rather fabulous trajectory, although the immense majority of that growth was as soon as in the firm’s knowledge heart enterprise.

Whereas Amazon in no arrangement experienced that more or less intense growth spurt, it has repeatedly been a mammoth earnings driver for the e-commerce extensive, and each corporations enjoy experienced first market lend a hand. Over the years, although, Microsoft and Google enjoy joined the market setting up the Principal Three cloud vendors, and it is miles predicted that other chip makers will indirectly divulge in confidence to reach foremost market portion, too, even because the earnings pie continues to grow over the next several years.

Every corporations were clearly in the exquisite assert on the exquisite time. As web apps and cell began rising spherical 2010, the cloud supplied the on-inquire resources. Enterprises soon began to peek the price of inspiring workloads or building applications in the cloud, quite than working their enjoy knowledge products and services. Equally, as AI took off over the final decade, and mammoth language models more unbiased no longer too lengthy ago, it coincided with the explosion in the utilize of GPUs to route of these workloads.

Over the years, AWS has grown into a seriously worthwhile enterprise, currently on a flee payment cease to $100 billion, one which even spoil away Amazon would be a highly worthwhile firm. But AWS growth has begun to silly down, even as Nvidia’s takes off. It’s partly the regulation of mammoth numbers, something that will indirectly affect Nvidia, too.

The search data from is whether Nvidia can maintain that growth to become a lengthy-timeframe earnings powerhouse savor AWS has become for Amazon. If the GPU market begins to tighten, Nvidia does enjoy other corporations, but as this chart shows, these are primary smaller earnings generators which will most most likely be rising rather more slowly than the GPU knowledge heart enterprise currently is.

Portray Credits: Nvidia

The non eternal financial outlook

As the above chart notes, Nvida’s earnings growth has been tall in fresh quarters. And per each Nvidia and Wall Toll road analysts, it’s self-discipline to proceed.

In its fresh earnings file covering the fourth quarter of its fiscal 2024 (the three months ending January 31, 2024), Nvidia told its investors that it anticipates $24 billion payment of earnings in its most smartly-liked quarter (Q1 FY25). When when put next with its year-ago first quarter, Nvidia expects to put up growth of spherical 234%.

That is merely no longer a quantity we continually peek from outmoded public corporations. Nevertheless, given the firm’s extensive earnings ramp in fresh quarters, its growth payment is predicted to claim no. From a 22% earnings reach from the third to fourth quarter of its unbiased no longer too lengthy ago concluded fiscal year, Nvidia anticipates a more modest 8.6% growth payment from the final quarter of its fiscal 2024 to the first of its fiscal 2025. Indubitably, on a year-over-year comparison and no longer a search back at correct three months, Nvidia’s growth payment remains unimaginable for essentially the most smartly-liked duration. But there are other growth declines on the horizon.

As an illustration, analysts request Nvidia to generate $110.5 billion payment of earnings in its most smartly-liked fiscal year, up correct over 81% from its year-ago results. That’s dramatically lower than the 126% reach it posted in its unbiased no longer too lengthy ago concluded fiscal 2024.

To which we search data from: So what? For as a minimal the next several quarters, Nvidia is predicted to proceed scaling its earnings past the $100 billion annual flee payment payment, spectacular for a firm that in its year-ago duration on the present time seen total revenues of correct $7.19 billion.

In short, analysts, and to a more modest diploma Nvidia, peek enormous buckets of growth forward for the firm, although a few of the survey-popping earnings growth figures will silly this calendar year. It’s unclear what happens on a quite longer timeframe.

Momentum forward

It looks to be AI is most likely to be the present that keeps on giving for Nvidia for the next several years, even as more opponents from AMD, Intel and other chipmakers begins to emerge. Mighty savor AWS, Nvidia will face stiffer opponents indirectly, on the opposite hand it controls so primary of the market exquisite now, it’ll afford to cede some.

Having a search at it purely on the chip diploma, no longer at boards or other adjacencies, IDC shows Nvidia firmly up to slip:

Portray Credits: IDC

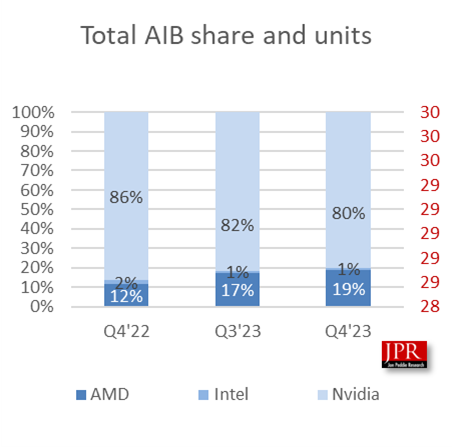

In case you sight on the board diploma with these market portion numbers from Jon Peddie Be taught (JPR), a firm that tracks the GPU market, whereas Nvidia quiet dominates, AMD is approaching stronger:

Portray Credits: Jon Peddie Be taught

C Robert Dow, an analyst at JPR, says these sorts of fluctuations favor to have with when original merchandise are launched. “AMD good points percentage aspects here and there counting on cycles available in the market — when original playing cards are launched — and inventory phases, but Nvidia has been in a dominant plan for years, and that will proceed,” Dow told TechCrunch.

Shane Rau, an IDC analyst who follows the silicon market, also expects the dominance to proceed, even as inclinations shift and swap. “There are inclinations and countertrends, the markets whereby Nvidia participates are mammoth and getting better, and growth will proceed, as a minimal for one other 5 years,” Rau said.

Segment of the self-discipline off of that is Nvidia is selling greater than correct the chip itself. “They’ll sell you boards, systems, instrument, products and services and time on one among their enjoy supercomputers. So any of these markets are mammoth and rising and Nvidia is connected to all of them,” he said.

But no longer everyone sees Nvidia as an unstoppable force. David Linthicum, a longtime cloud advisor and author, says that you don’t repeatedly need GPUs, and corporations are starting to clutch that. “They are saying they need GPUs. I sight at it, have a few of the back of the envelope math, and so they don’t need them. CPUs are perfectly splendid,” he said.

As this happens, he thinks Nvidia will divulge in confidence to silly down and opponents will loosen its stronghold in the marketplace. “I mediate that we’re going to peek Nvidia morph into a weaker player over the next couple of years. And we’re going to peek that because of there’s too many substitutes which will most most likely be being constructed available.”

Rau says other vendors will also lend a hand as corporations lengthen AI utilize circumstances with Nvidia merchandise. “What I mediate you’ll peek going forward is rising markets that’ll fabricate tailwinds for Nvidia. But then there’ll be other corporations that also follow in these tailwinds that could enjoy the good thing about AI seriously.”

It’s also that it’s good to possibly imagine that some disruptive force will come into play and that could be a obvious consequence to preserve one firm from changing into too dominant. “You nearly hope disruption will happen because of that’s the skill markets and capitalism work most productive, exquisite? Somebody gets an early lead, other suppliers follow, the market grows. You secure established gamers, who’re indirectly disrupted by a greater skill to have the a comparable element within their market or within adjacent markets which will most most likely be crossing into theirs,” Rau said.

The truth is, we are starting to peek that going down at Amazon as Microsoft good points floor by the utilize of its relationship with OpenAI and Amazon is forced to play secure-up in phrases of AI. In spite of happens to Nvidia in the lengthy term, it’s firmly in the driver’s seat exquisite now, getting cash quit fist, dominating a rising market and having correct about all the things going its skill. But that doesn’t indicate this is in a position to moreover repeatedly be this implies or that there won’t be more competitive stress down the motorway.